Web3 Bank: Managing Your Crypto & Fiat

Web3 banking isn't just a buzzword — it's a quiet revolution reshaping our financial landscape. While traditional banks scramble to adapt, a new generation of financial services is emerging. Web 3.0 banking and web3 finance are redefining ownership, accessibility, and control in ways that challenge our very concept of money.

Best Web3 Banking Apps

Web3 banking apps are revolutionizing financial management, combining traditional banking with blockchain technology. These web3 mobile apps offer user-friendly interfaces for managing both crypto and fiat currencies. Here's a look at some leading web3 wallet apps:

CrossFi

A comprehensive banking solution

-

Non-custodial payment

-

Virtual and physical card issuance

-

Cross-border transfers

Coinbase

A comprehensive banking solution

-

USD accounts with FDIC insurance

-

Crypto-backed loans

-

Visa debit card

Celsius Network

A comprehensive banking solution

-

Interest-earning accounts

-

Crypto-backed loans

-

Mobile app for easy management

BlockFi

A comprehensive banking solution

-

Interest-bearing accounts

-

Crypto-backed loans

-

Trading platform

Nexo

A comprehensive banking solution

-

Instant crypto credit lines

-

High-yield savings accounts

-

Crypto exchange

Revolut

A comprehensive banking solution

-

Multi-currency accounts

-

Crypto trading

-

Virtual and physical cards

Top Web3 Banking Apps

CrossFi App

A comprehensive web3 app for managing crypto and fiat. It features non-custodial payments, card issuance, and multi-currency management, functioning as both a digital wallet and a traditional banking app.

Get Started

Coinbase App

A popular crypto wallet and exchange platform. This dapp offers a built-in wallet, educational resources, and crypto earning opportunities.

Get Started

Celsius Network App

Focuses on crypto lending and borrowing. Users can earn interest on crypto holdings and manage digital assets.

Get Started

BlockFi App

Provides wealth management tools for crypto assets, including interest-earning accounts and a crypto rewards credit card.

Get Started

Nexo App

Offers instant crypto credit lines and high-yield savings accounts, bridging traditional finance and blockchain technology.

Get Started

Revolut App

A digital bank with integrated crypto features, allowing users to buy, sell, and hold cryptocurrencies alongside traditional banking services.

Get Started

Wirex App

Combines traditional and crypto finance with multi-currency accounts and a crypto-backed Visa debit card.

Get Started

Introduction to Web3 Banks

Imagine a world where your bank is as portable as your smartphone and as transparent as a glass house. That's the promise of web3 banking, the next big leap in our financial evolution. This new breed of banking isn't just a fancy upgrade; it's a complete reimagining of how we handle money in the digital age.

Key Differences from Traditional Banks

Picture traditional banks as fortresses and web3 banks as bustling marketplaces. While old-school banks keep your money locked away, web3 finance sets it free to mingle and multiply. In this new world, there's no stuffy banker deciding what you can do with your cash. Instead, you're part of a vibrant ecosystem where your crypto assets can be put to work instantly. It's like having a financial Swiss Army knife – versatile, always ready, and fits right in your digital pocket.

Technological Foundations of Web3 Banks

Under the hood, web3 banks are powered by some seriously cool tech. Blockchain isn't just a buzzword here; it's the engine driving this financial revolution. Imagine your transactions being recorded on an unbreakable, global ledger – that's blockchain in action. Smart contracts act like tiny, incorruptible bankers, faithfully executing your financial wishes without bias or breaks. And tokens? They're the shape-shifting currency of this new realm, able to represent anything from cold, hard cash to your share in a revolutionary new project.

Advantages of Web3 Banks

The benefits of web3 banking are as vast as they are revolutionary. This new financial frontier offers advantages that traditional banks simply can't match. Let's dive into the exciting perks of joining the web3 banking revolution:

-

24/7 Banking: Your money never sleeps, and neither does your bank.

-

Global Access: Bank from anywhere, anytime – all you need is an internet connection.

-

Faster Transactions: Send money across the world in minutes, not days.

-

Earn While You Save: Put your crypto to work with innovative yield-earning opportunities.

Decentralization and Data Security

Web3 banks are like digital fortresses, built on blockchain technology that's tougher than a titanium vault. This distributed ledger system encrypts your transaction details and important information without nosy intermediaries peeking in. Imagine a world where your financial data is scattered across thousands of computers, making it virtually hack-proof. That's the magic of web3 security.

Enhanced Transparency and Accessibility of Services

In the world of web3 banking, your transactions are like an open book – but only you have the key. Users can easily trace the movement of assets, creating a level of transparency that traditional banks can only dream of. This crystal-clear view of your finances is powered by rock-solid blockchain algorithms and infrastructure.

Successful Projects in the Web3 Banking

In the vibrant world of Web3, decentralized finance (DeFi) projects are turning the financial world on its head. These innovative platforms are rewriting the rules of banking, offering services that traditional banks can only dream of. Let's dive into some of the trailblazers in this exciting new frontier:

-

24/7 Banking: Your money never sleeps, and neither does your bank.

-

Global Access: Bank from anywhere, anytime – all you need is an internet connection.

-

Faster Transactions: Send money across the world in minutes, not days.

-

Earn While You Save: Put your crypto to work with innovative yield-earning opportunities.

These projects are just the tip of the iceberg in the growing web3 ecosystem, showcasing the immense potential of blockchain technology in finance.

The Future of Web3 Banks

Imagine a world where your bank is as innovative as a tech startup and as secure as Fort Knox. That's the promise of Web3 banks. These financial trailblazers are set to revolutionize how we save, spend, and invest. Let's peek into the crystal ball and see what the future holds for this exciting new frontier in finance.

Prospects of Blockchain Technology and Smart Contracts in Banking

Blockchain and smart contracts are like the dynamic duo of Web3

banking, ready to transform the financial world. Conducting

peer-to-peer transactions directly, without a bank acting as a

middleman: that's the power of smart contracts on blockchain

platforms.

These technologies could revolutionize everything from mortgages

to international trade. Need a loan? A smart contract could assess

your creditworthiness and disburse funds in minutes. Buying a

house? Blockchain could make the process as simple as buying a

coffee.

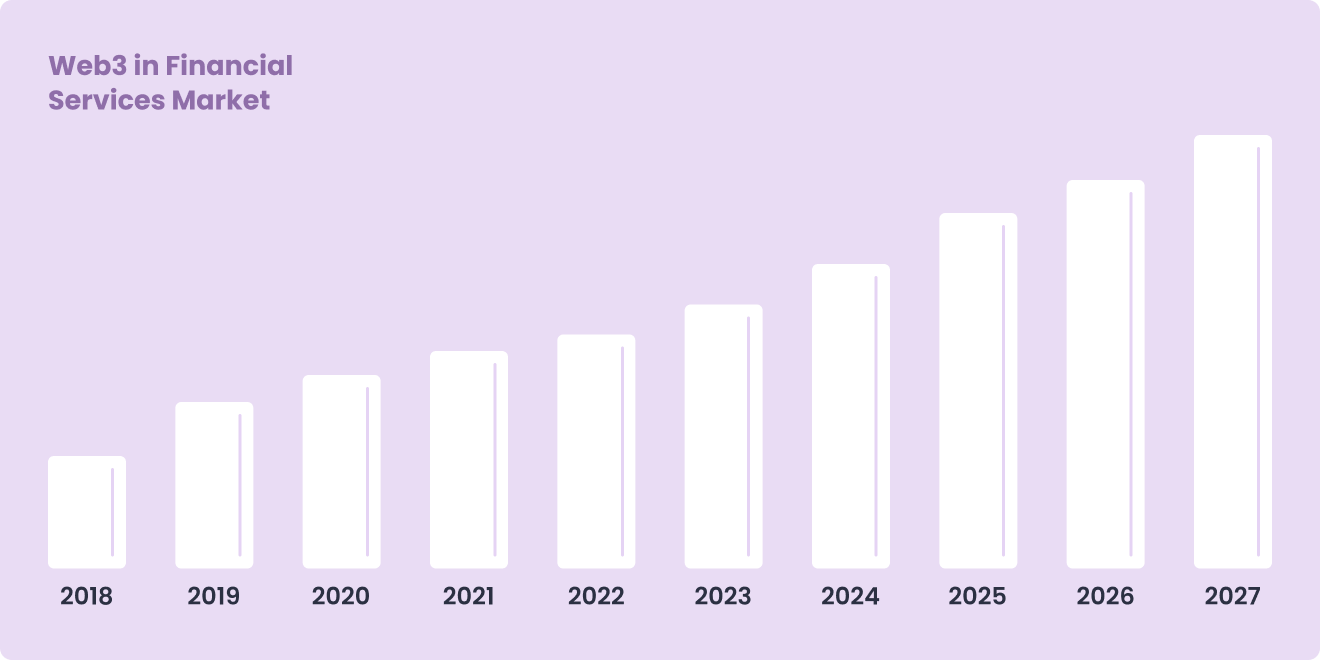

Growth and Development Forecasts for the Web3 Banking Sector

These projects are just the tip of the iceberg in the growing web3 ecosystem, showcasing the immense potential of blockchain technology in finance.

-

CrossFi: Bridging the gap between crypto and traditional finance

-

Aave: Pioneering decentralized lending and borrowing

-

Uniswap: Revolutionizing cryptocurrency exchanges

-

Compound: Offering interest-earning opportunities on crypto assets

These projects are just the tip of the iceberg in the growing web3 ecosystem, showcasing the immense potential of blockchain technology in finance.

Challenges and Risks

Web3 banking is an exciting frontier, but it comes with its own set of challenges. Let's explore these hurdles and how they shape the future of finance.

Regulation and Legislation

One of the main challenges in web3 banking is navigating the complex world of regulations. Traditional banks operate within clear rules. But web3 banking, with its borderless nature, often falls outside typical regulatory frameworks. This creates a unique landscape where innovation thrives, but also where caution is needed. As the sector grows, finding a balance between freedom and oversight will be key to its success.

Security and Risk Management

Security is a top priority in web3 banking. The transparent nature of blockchain transactions brings both benefits and risks. While it's harder to hide fraudulent activities, new types of vulnerabilities have emerged. Smart contract exploits, where attackers find loopholes in code, are a concern. Wallet breaches can lead to significant losses. Even decentralized autonomous organizations (DAOs) face risks from coordinated attacks. Despite these challenges, the web3 community is constantly innovating to create safer systems.

Onboarding New Users and Ensuring User-Friendliness

Bringing new users into the web3 world is both exciting and

challenging. Traditional banks have well-established ways to

verify customers. Web3 banking needs to create smooth,

secure processes without compromising privacy. The goal is

to make joining as easy as signing up for a social media

account, but with bank-level security. This balance of

simplicity and safety is crucial for widespread adoption.

As we face these challenges, it's important to remember the

potential of web3 banking. Each hurdle overcome brings us

closer to a more open, efficient financial system. The

community's creativity and determination continue to drive

progress, making the future of finance look brighter than

ever.

Web2 VS Web3

Web2, the internet we're familiar with, relies on centralized systems. Web3, powered by blockchain technology, offers a new approach. It's built on the principles of decentralization, transparency, and user empowerment.

Aspect |

Web2 |

Web3 |

|---|---|---|

Technology |

Centralized servers |

Blockchain and distributed networks |

Governance |

Controlled by companies |

Community-driven, often using DAOs |

Censorship |

Possible content removal |

Resistant to censorship |

Ownership |

Platform owns user data |

Users own their data and assets |

Privacy |

Limited user control |

Enhanced privacy through encryption |

What Our Experts Say

John Smith, Fintech Analyst:

"Web3 banking is like giving your money superpowers. It's like having a Swiss Army knife for your finances — versatile and handy. The non-custodial approach is refreshing, putting users in the driver's seat. It's not just banking; it's financial empowerment on steroids. And CrossFi's platform is a prime example, blending crypto and traditional finance seamlessly."

Maria Rodriguez, Blockchain Researcher:

"Web3 banking's potential is starting to shine. It's like they've created a financial Esperanto, allowing your money to speak multiple languages fluently. CrossFi is bridging the crypto-fiat divide with flair. Their non-custodial system is a game-changer, offering the best of both worlds."

Conclusion

Web3 banking isn't just a tech upgrade — it's a financial revolution in your pocket. It's turning your smartphone into a global bank branch, your crypto wallet into a universal passport for wealth. As traditional banking and blockchain technology tango, we're witnessing the birth of a financial ecosystem that's as borderless as the internet itself. The future of money is here, and it's speaking the language of web3.

FAQ

Can I order pizza using my web3 wallet?

Absolutely! With platforms like CrossFi, you can link your web3 wallet to a physical card. So, whether it's pizza or groceries, you can make everyday purchases using cryptocurrency, bridging the gap between web3 and traditional commerce.

Will my grandma understand web3 banking?

Web3 apps are becoming increasingly user-friendly. CrossFi, for instance, simplifies complex blockchain technology into intuitive interfaces. So while your grandma might not grasp all the technicalities, she could easily use the basic features of a web3 bank.

Can web3 banking help me avoid awkward IOUs after group dinners?

Definitely! Web3 banking platforms often include features for easy peer-to-peer transfers. You can split bills instantly using cryptocurrency or fiat, making those post-dinner calculations a thing of the past.

If I lose my phone, do I lose access to my web3 bank?

A: Not at all. Most web3 banks use decentralized systems, meaning your assets aren't tied to a single device. With your private keys or recovery phrases, you can access your funds from any device, anytime.

Can I use my NFT collection as collateral in web3 banking?

Some innovative web3 banks are exploring this possibility. While it's not widespread yet, the integration of NFTs and security tokens into banking services is an exciting frontier in decentralized finance.